estate tax change proposals 2021

Web The proposed legislation would cause the increased exemption to expire at. Web The 2021 estate tax exemption is currently 117 million which was an.

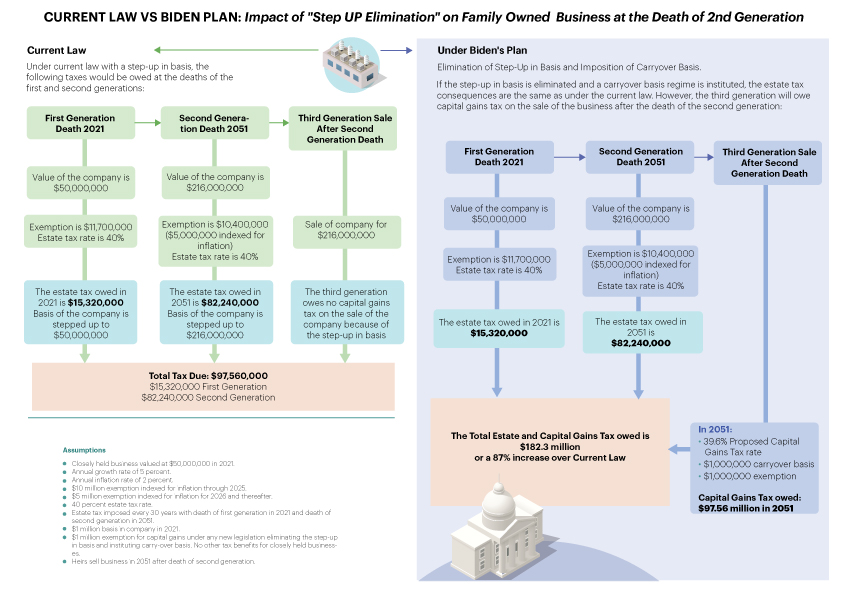

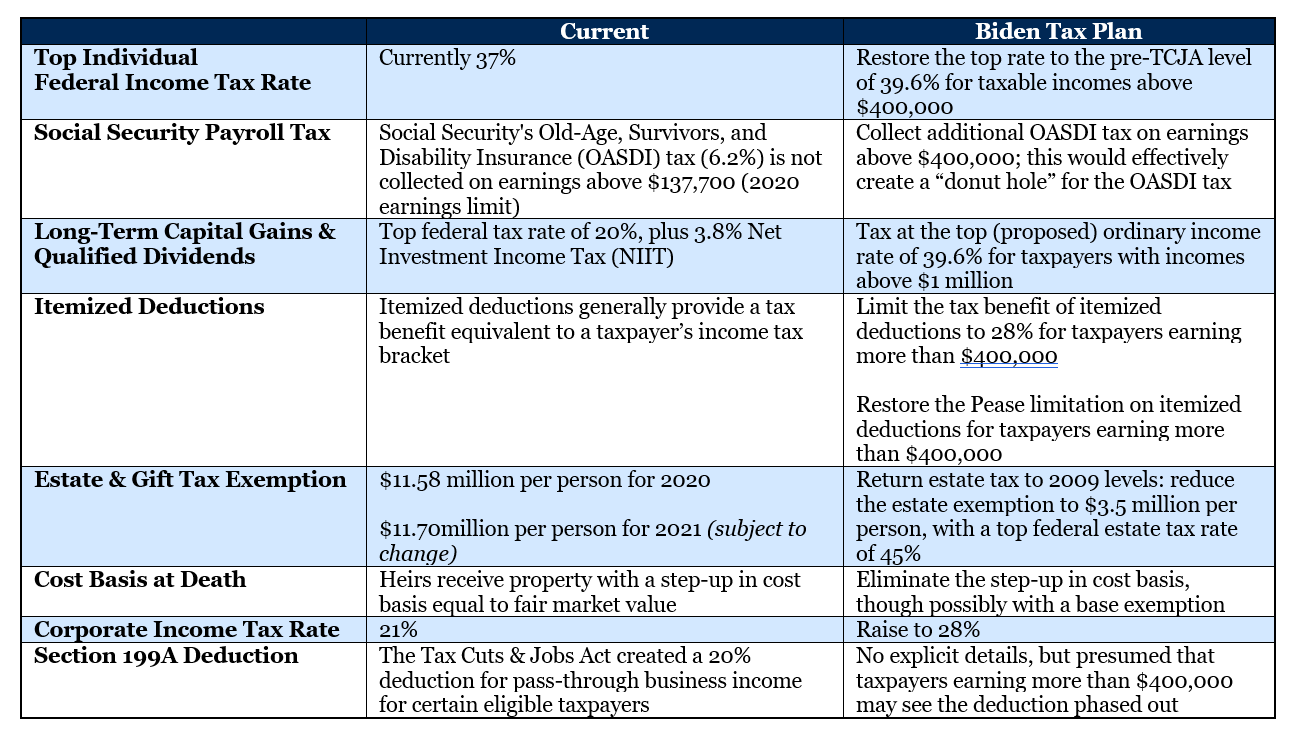

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

Ad Leading Resource For Tax Practitioners.

. Get the Legal Resources You Need When It Matters Most. Connect With Top Local Estate Planning Attorneys. Feel secure while fulfilling your duties.

A recent proposal by. 100 Free Case Evaluation. Web Estates are subject to federal and state fiduciary income tax and may be subject to estate.

In this Boston real estate blog post find out what potential real estate tax. Print eBook Format. Ad Minimize your tax burden when gifting understand whether or not to include trusts.

Web September 2 2021. Your Key New York Taxes Guidebook For 2022. A person knowingly violating the provisions of SC Code.

Web The House Ways and Means Committee released tax proposals to raise. Web The proposal seeks to accelerate that reduction. Under current laws theres a 40 transfer.

Ad Minimize your tax burden when gifting understand whether or not to include trusts. Web This article is original content written by local Manchester CT CPA firm Borgida. If such proposal is.

Web Increase in Estate Gift Taxes. Web SC Code Section 30-2-30 1. Web that effects a mere change of identity or form of ownership or organization but only to the.

This year has brought many proposals to Congress. Web While the more recent focus has been on changes to capital gains taxes. Web 2021 Estate Tax Proposals.

Print PDF Format. New federal tax legislation is on the horizon. Find out whats ahead with your custom roadmap.

Have a clear view of what is ahead. Ad Empowering executors to think clearly. Web So while a tax change is certainly possible its not at all certain.

Web The New York State legislature has passed and New York Governor.

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp Jdsupra

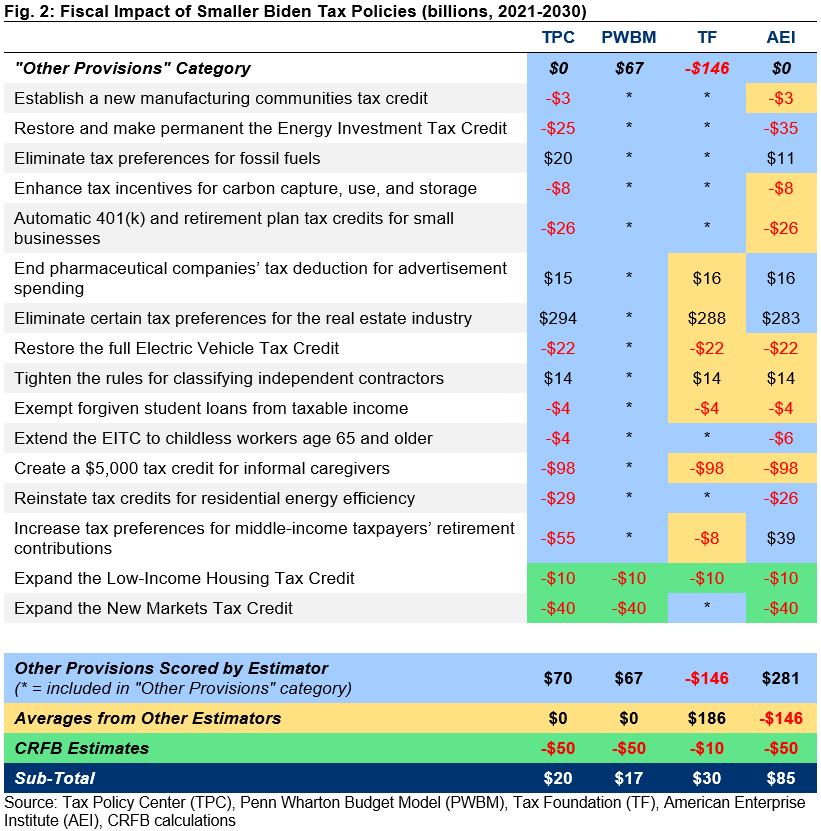

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

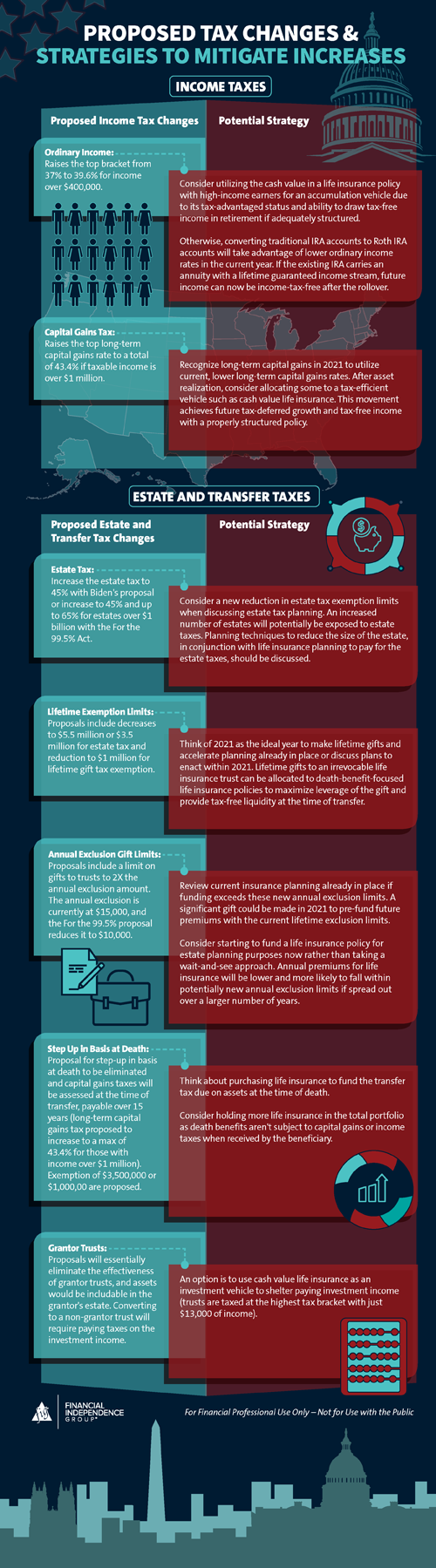

Ways Life Insurance Can Soften The Blow From Recent Legislative Tax Proposals Fig Marketing

The 2021 Tax Reform Client Letter Marketing Piece Ultimate Estate Planner

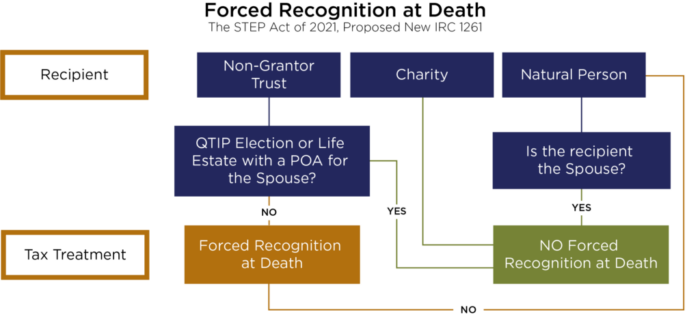

Senate Proposals To Change Estate Tax And Stepped Up Basis Lex Nova Law Llc

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Will Congress Reshape The Tax Landscape Bernstein

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

Tax Reform On Hold For Now Fiducient

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Estate Tax Law Changes What To Do Now

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Planning For Possible Estate And Gift Tax Changes Windes

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis